CFA Program: From Selection to Success

By CA Bhavna Goel, FCA, CFA, FRM, CAIA

12 October 2024

CFA Compass :

Navigating Your Academic Path

Are you considering taking the CFA Level I exam, you likely have some questions. Our experts are always available to assist you with any inquiries regarding your exam preparation. Additionally, we’ve put together this article to address some of the most frequently asked questions from those preparing to embark on their journey to becoming a CFA charterholder.

- What is the CFA Charter?

- How can I earn the Charter?

- What are the requirements for sitting for the CFA Exam?

- Why should you pursue CFA?

- What are the career options after completing CFA?

- What is the format of the Exam?

- Which topics are tested for the CFA Exam?

- How Much Time Does It Take to Study for the Exam?

- When are exams conducted?

What is the CFA Charter?

Let’s begin with the fundamentals. The CFA, or Chartered Financial Analyst, is a professional designation awarded by the CFA Institute. It focuses on investment management and financial analysis. The program is known for its rigorous curriculum, covering topics like ethics, investment tools, asset valuation, and portfolio management.

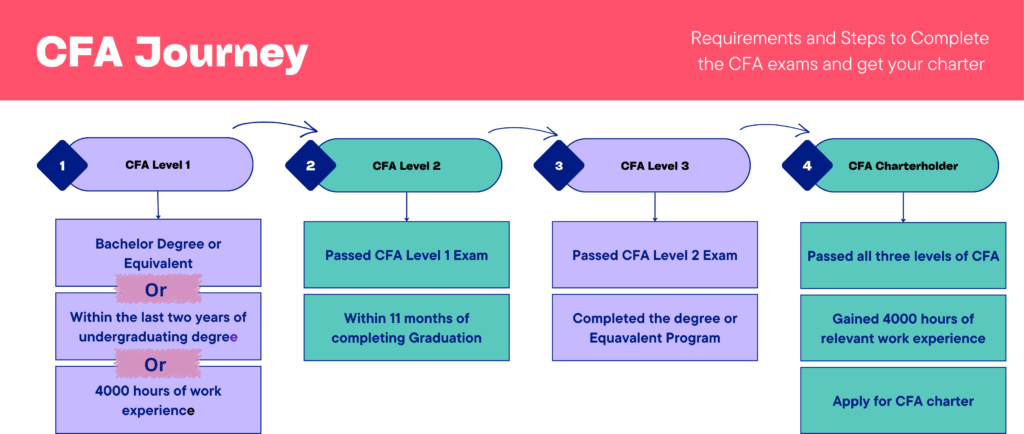

How can I earn the Charter?

To earn the charter, you have to complete the Level I, II, and III CFA exams. Each level focuses on different aspects of investment management and financial analysis. Also, at the time of charter, you need to accumulate at least four years of professional work experience in investment decision-making or related fields.

What are the requirements for sitting for the CFA Exam?

An individual looking to enroll in the Program and register for the Level I exam for the first time must have an international travel passport. Additionally, candidates must meet one of the following criteria:

Enrolling for Level 1 Exam –

- Have a bachelor’s degree (or equivalent)

- Or 23 months remaining in your undergraduate studies

- Or have accumulated 4,000 hours of applicable professional work experience

Level 2 Exam – You must be within 11 months of completing graduation

Level 3 CFA exam – You should have completed your degree or equivalent program.

Why should you pursue CFA?

Pursuing a CFA is a strategic investment in your finance career, providing knowledge, recognition, and advancement opportunities.

Core Benefits

- Global Recognition: Respected worldwide, enhancing your credibility in finance

Stream Independence: Open to graduates from any background, allowing for diverse transitions into finance - Study While Working: Complete the CFA alongside your graduation or job for practical experience

- Comprehensive Knowledge: Covers key areas like investment analysis and portfolio management

- Networking Opportunities: Connects you with finance professionals for job opportunities

- Ethical Standards: Emphasize integrity and build a solid professional reputation

- Personal Development: Enhances analytical skills and discipline

Career Advancement Benefits

- Advanced Roles: Qualifies you for senior positions in investment management and analysis

- Diverse Opportunities: Opens doors in asset management, private equity, and more

- Higher Salaries: CFAs often earn more than their non-chartered peers

- Promotion Prospects: Increases chances of advancement in your career

- Competitive Edge: Recognized as a standard of excellence by employers

- Global Mobility: Facilitates opportunities in international finance

- Leadership Preparation: Equips you for leadership roles with ethical training

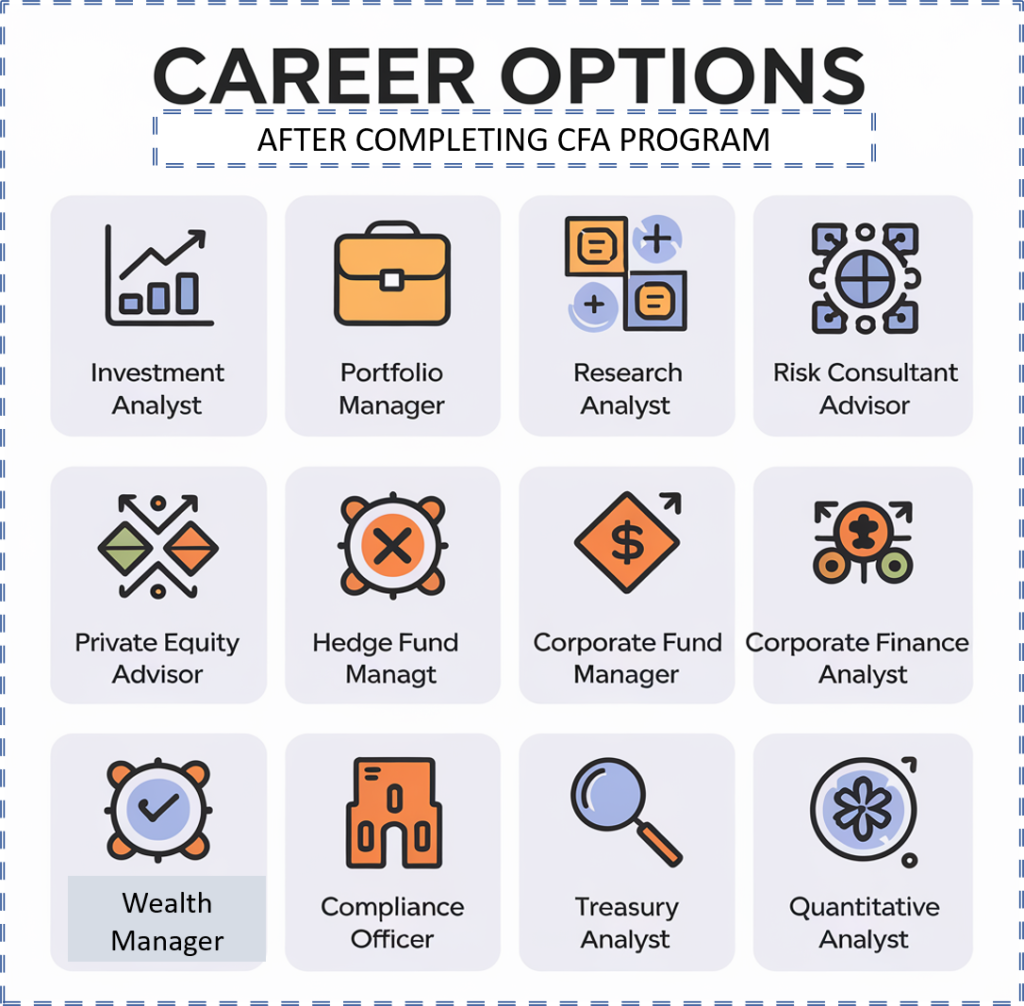

What are the career options after completing CFA?

-

Investment Analyst

-

Portfolio Manager

-

Research Analyst

-

Risk Manager

-

Financial Consultant/Advisor

-

Private Equity Analyst

-

Hedge Fund Manager

-

Corporate Finance Analyst

-

Wealth Manager

-

Compliance Officer

-

Treasury Analyst

-

Quantitative Analyst

What is the format of the Exam?

CFA Level I:

- Format: Multiple-choice questions

- Number of Questions: 180 questions, split into two sessions (90 questions each)

- Duration: 4.5 hours total (2 hours 15 minutes per session)

- Topics: Focuses on basic knowledge and comprehension of investment tools and ethical standards.

Level II:

- Format: Item sets (case studies)

- Number of Questions: 88 items, organized into 22 item sets (4 questions per set)

- Duration: 4 hours and 24 minutes total (2 hours and 12 minutes per session)

- Topics: Emphasizes the application of concepts and analysis in investment valuation.

CFA Level III:

- Format: Constructed response (essay questions) and item sets

- Number of Questions: A mix of essay questions and item sets; specific numbers can vary by exam cycle. Overall, the Level III exam contains 11 item sets and 11 essay sets

- Duration: 4 hours and 24 minutes total (2 hours and 12 minutes per session)

- Topics: Focuses on portfolio management and wealth planning, requiring candidates to demonstrate their ability to synthesize information and apply concepts in real-world scenarios.

Get in Touch!

All levels emphasize ethical and professional standards throughout the curriculum.

Which topics are tested for the CFA Exam?

The syllabus covers a broad range of topics with a main focus on portfolio management

Topics | CFA Level 1 | CFA Level 2 | CFA Level 3 |

|---|---|---|---|

Quantitative Methods | 8-12% | 5-10% | 0% |

Economics | 8-12% | 5-10% | 5-10% |

Financial Statement Analysis | 13-17% | 10-15% | 0% |

Corporate Issuers | 8-12% | 5-10% | 0% |

Equity Investments | 10-12% | 10-15% | 10-15% |

Fixed Income | 10-12% | 10-15% | 15-20% |

Derivatives | 5-8% | 5-10% | 5-10% |

Alternative Investments | 5-8% | 5-10% | 5-10% |

Portfolio Management /Wealth Planning | 5-8% | 10-15% | 35-40% |

Ethical & Professional Standards | 15-20% | 10-15% | 10-15% |

How Much Time Does It Take to Study for the Exam?

The average candidate is required to dedicate approximately 300 hours of study for each level of the CFA exam.

Individual study needs may vary based on prior knowledge, learning style, and familiarity with the material. Some candidates may need more or less time, so remember that you should create a study plan that works for you.

Create your Study plan now!

When are exams conducted?

The CFA exams are typically held annually for each of the three levels, but the schedule can vary slightly each year. As of recent schedules:

- Level I: Offered in February, May, August, and November

- Level II: Offered in May and November

- Level III: Offered in Feb, August and November

![]()

It's always a good idea to check the official CFA Institute website for the most current dates and any updates regarding exam schedules, as they may change.